- Average Rent

- Advice

- Forum

- +Sign Up

According to Zillow, the average residential rent rate in the United States is now $1,408. Since 2012, rental costs have been on the rise. Now, in some markets, a resurgence of construction and new vacancies has caused pressure on the market, causing the rate to rise, but more slowly than in the past.

Across the country, rents rose 0.7% from March 2016, the slowest rate of growth since November 2012.

Affordability is a growing concern for many renters, as increased prices put pressure on their ability to save for a down payment, and also encroach beyond the standard measure of 30% of monthly income being allocated for rent. In some markets, landlords and property managers are adjusting their calculations for affordability.

There is a slight decline in occupancy nationally, again largely attributed to new construction in some areas softening the market.

Some of the more difficult spaces to fill are the top tier luxury Class A rentals. According to Jay Denton, vice president of RealPage's Axiometrics business group, "Pricing momentum remains strongest in the middle-market Class B properties. Results are more hit-and-miss moving up the spectrum in product quality. Top-tier projects in neighborhoods with the most construction are struggling to push rents at all."

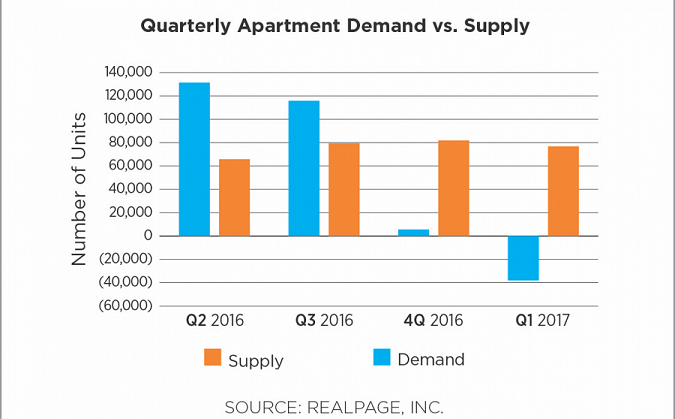

RealPage reports that national average rent growth for the first quarter of 2017 is 3.7 percent.

Some markets experienced a slight decline in rents. Houston has experienced the greatest decline, due to the pressure on the energy industry. High rents in San Francisco and San Jose have caused some renters to leave for other market areas, and are also experiencing rent decreases.

How does your rent rate compare with others in your market area? What are the local trends? Calculate a marketable rent rate for your property using our rent analyzer tool on MyRentRates.com.

Login or create and account to comment on this article Sign Up